Mastering Cloud Accounting

with Redmond Academy

Guide to Undeposited Funds in QuickBooks Online

Accounting systems are strange beasts. The undeposited funds account in QuickBooks Online is a mystery to many because it’s not intuitive. That unfamiliarity leads to bad data, mismatched transactions, and messy reconciliations. Below, I provide you with the...

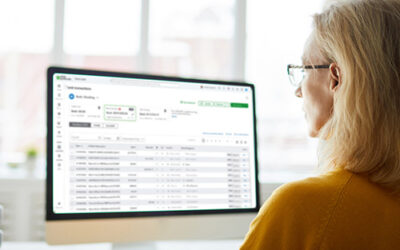

QuickBooks Online Bank Feeds: the Real Engine Behind Faster, Cleaner Books

Bookkeeping has always lived in the tension between accuracy and speed. Move too fast, and you create messes that show up later during reconciliation. Move too slow, and leadership is flying blind on outdated numbers. The QuickBooks Online bank feed is one of the rare...

Fraud Prevention in Accounting. Why Strong Workflows Matter More Than Ever

People often imagine fraud as an insider job; someone in the accounting department exploiting access, bypassing controls, or quietly altering records. Internal fraud does happen, but the modern landscape is much broader. Outside actors generate just as much risk, and...

Why Month End Closing Is Essential (and How to Do It Faster)

Whether you manage a single small business or dozens of client accounts, a firm, predictable close of each month is what separates reactive chaos from proactive control. The month-end closing process—when done consistently—becomes a strategic tool, not a burden. In...